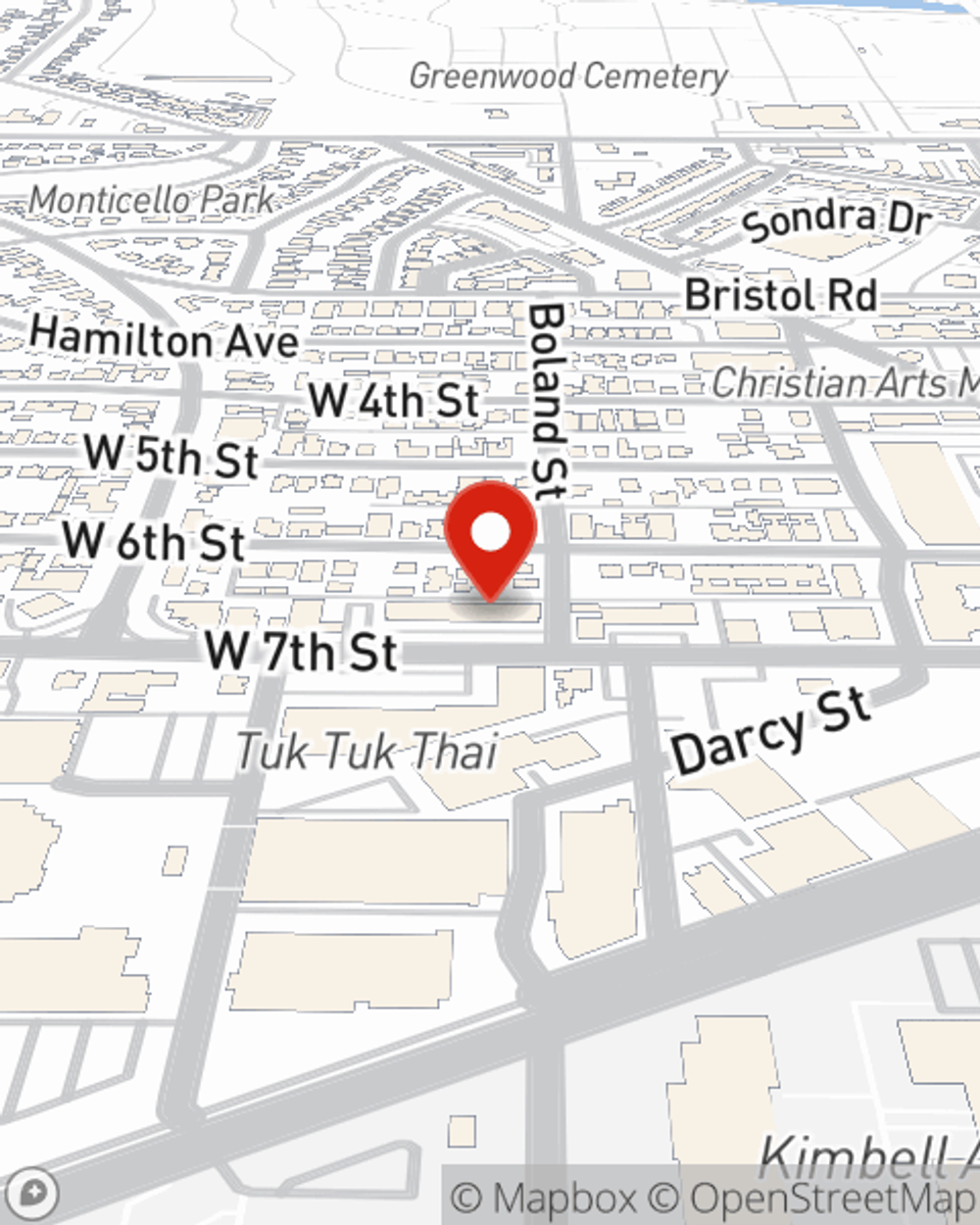

Business Insurance in and around Fort Worth

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

This Coverage Is Worth It.

Do you own a domestic cleaning service company, a camping store or a window treatment store? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on navigating the ups and downs of being a business owner.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Strictly Business With State Farm

Every small business is unique and faces a wide array of challenges. Whether you are growing a hobby shop or a bicycle shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Stephen Koper can help with worker's compensation for your employees as well as professional liability insurance.

Since 1935, State Farm has helped small businesses manage risk. Get in touch with agent Stephen Koper's team to discuss the options specifically available to you!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Stephen Koper

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.